1031 EXCHANGES

What is an IRC §1031 Tax Deferred Exchange?

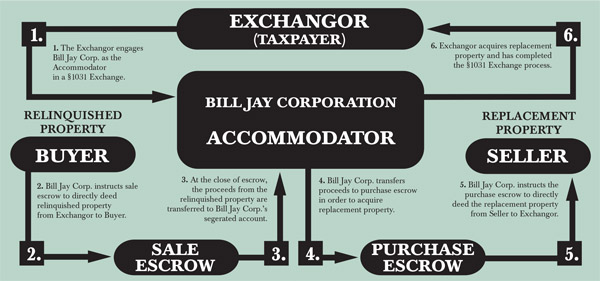

At time when most tax shelters have been abolished, one remains: the tax deferred exchange. A exchanger continues his/her investment selling one piece of property (the relinquished property /first leg and then uses the proceeds to purchase a second property (the replacement property /second leg). Under internal Revenue Code §1031, the Exchanger may defer the gain realized by reinvesting in “like-kind” property. In this way, the taxpayer is able to reinvest 100% of the sales proceeds without paying any capital gains tax.

Once an Exchanger has transferred the relinquished property, several requirements must be satisfied to quality as a tax deferred exchange under §1031. The taxpayer must identify “like-kind” replacement property within 45 days from the first closing and close on the replacement property(S) within 180 days of the closing of the relinquished property.

Exchange Calculator

Click to Print

What is Qualified Intermediary?

A qualified intermediary is an independent third party, or “middleman”, who enters into an exchange agreement with the taxpayer/Exchangor, acquires the original property, sells it to the buyer and holds the proceeds until the Exchangor identifies the replacement property. The regulations encourage the use of a qualified intermediary throughout the exchange.

What should I look for in a Qualified Intermediary?

With an IRC §1031 exchange escrow, care should be exercised in selecting an experienced and professional qualified intermediary who is familiar with exchanges and can satisfy the practical concerns of the parties.

The qualified intermediary should be a corporation instead of an individual, primarily because a corporation has unlimited life. The death or incapacity of an individual acting as the qualified intermediary could subject the exchange to a probate action and cause serious delays or even jeopardize the exchange.

Requirements and Procedures of the §1031 Tax Deferred Exchange

In order for your property to qualify for a §1031 exchange escrow the following must be true:

- Both the relinquished property and the replacement property must be held either for investment or for productive use in a trade or business.

- The property must be like kind. Real property must be exchanged for real property. Personal property must be exchanged for personal property.

- There must be an actual reciprocal transfer of properties – a deed for a deed.

The escrow company handling the escrow for the relinquished property sends the accommodator, Bill Jay Corp., Escrow Instructions and the Preliminary Title Report. From that information Bill Jay Corp. prepares an Exchange Agreement and an Assignment of Party’s Interest to Complete Exchange. These documents are returned to escrow to obtain the signatures of you, the Exchangor, and the Buyer.

When the relinquished property escrow close you will receive a letter from Bill Jay Corp. advising you of the date your escrow closed and the amount of funds Bill Jay Corp. received from escrow. You will also receive a property identification from with the letter which you close of escrow of your relinquished property.

You may identify up to three replacement properties. As an alternative, you may identify any number of properties as long as their aggregate fair market value does not exceed 200 percent of the property you relinquished. As a final option, you may identify any number of properties as long as your acquire at least 95 percent of the aggregate fair market value of all the identified replacement propertied before the end of the 180 days period.

An identification of a property may be revoked in writing any time during the 45 day period.

While Bill Jay Corp. is holding your funds, you will receive a monthly analysis advising you of the activity on your account. A final analysis will be sent to you after the close of escrow of your replacement property.

At your request, we will send a deposit to the replacement property escrow when escrow opens. The process of our obtaining Escrow Instruction and the Preliminary Title Report is repeated. Bill Jay Corp. then produces the Amendment to Escrow and Assignment of Rights and Delegations of Duties and sends it to escrow to obtain the signatures of you, the Exchangor, and the Seller.

Escrow on the replacement property must close no later than 180 days after the close of escrow of the relinquished property. If a tax return is due during the 180 day period, an extension of time to file the return must be obtained.

Generally speaking, to completely defer all capital gain taxes, you must use all of the net proceeds from your relinquished property in the purchase of your replacement property. You must also obtain a mortgage on your replacement property equal to, or greater than, the mortgage on your relinquished property. However, certain losses may affect the amount that is necessary to invest in the replacement property. You should consult with your tax preparer regarding your potential recognized gain.

In a like-kind exchange, if the property exchanged is to or from a related party, it must be held for tow years. Please call us for a further explanation if you feel this may apply to you.

It is also important that you do not have actual or “constructive receipt” of the funds during the exchanged process. No funds from the transaction should be received by the taxpayer until all replacement property has been acquired.

If you exchange California real property for out-of-state real property, California tax law provides for the nonrecognition of gain on the exchange. This allows you to defer the gain into the basis of the real property received. However, upon the sale of the replacement real property now located outside of California, the portion of the gain attributable to the increase in value of the California real property during the period it was held by you will be income from California sources. This income should be reported as such on a California form 540 NR.

Like-Kind Property

Pursuant to Internal Revenue Code §1031, like-kind property held for the productive use in a trade or business or for investment purposes. Neither the Relinquished Property not the Replacement Property can be the principal residence of the Taxpayer. Please note that with a personal property exchange, “like-kind” means identical property.

What Language Should I Put In the Sales Contract?

“Buyer hereby acknowledges that is the intent of the Seller to a §1031 Tax Deferred Exchange. The Seller”s right and Obligations under this agreement are hereby assigned to Bill Jay Corp. (The above language may be used for the Replacement Property by Substituting “Buyer” for “Seller” and “Seller” for “Buyer”).

Disbursement of Exchange Funds

- The rules of an exchange allow the Taxpayer access to the exchange funds only upon the following conditions:

- Exchanger has purchased all the Replacement Property identified and the Identification Period has expired.

- Exchanger has not identified any Replacement Property within the 45-day period.

The 180-day exchange period has elapsed.

§1031 Exchanges: An Overview

Internal Revenue Code §1031:

“No gain or loss shall be recognized on the exchange of held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held either for productive use in a trade or business or for investment.”

§1031 exchanges provide investors with one of the best tax strategies for preserving the value of an investment portfolio. By using an exchange the investor is able to defer the recognition of capital gain taxes that would otherwise be incurred on the sale of investment property. The investor can then use the entire amount of the equity to purchase substantially more replacement property. To qualify as an exchange the relinquished and replacement properties must be qualified “like kind” properties and the transaction must be structured as an exchange. Using Bill Jay Corp. as the “Qualified Intermediary” will provide the investor with the necessary reciprocal transfer of properties and the “Safe Harbor” protection against actual and constructive receipts of the exchange funds as required by §1031.

A Few Words About Bill Jay Corporation

Bill Jay Corporation is an independent Qualified Intermediary for IRC Section §1031 Tax deferred exchange transactions. Bill Jay Corporation was Originally incorporated on June14, 1989.

We have developed an outstanding reputation throughout the industry as the leader in §1031 Exchanger Intermediary services. Our knowledgeable staff, combined with out commitment to service with integrity, provides investors with an unparalleled professional team. We are members of the Federation of Exchange Accommodators.

Everyone at Bill Jay Corporation is committed to providing unsurpassed service to our clients. Our innovative techniques in structuring exchanges, combined with the industry’s most experienced and specialized team, bring multidimensional insights to structure even the most challenging exchange documentation within several hours for rush transaction.

In our continuing effort to maintain the highest level of customer service, we have developed a manual to highlight and explain some of the requirements and issues concerning IRC §1031 Tax Deferred Exchanges.

Trust your Transaction to the Experts

Bill Jay Corporation, Affiliate of Allison-McCloskey Escrow Company, specialize in managing tax-deferred property exchanges. Bill Jay Corporation is perfectly positioned to help investors, real estate professionals, and escrow officers maximize savings in §1031 exchanges. Our 69 years of experience in the escrow industry and our familiarity with IRS, Treasury Department, and other legislative regulations enable us to process your transaction smoothly, and thoroughly, from start to finish.

Terminology of §1031 Exchanges

Section §1031 of the Internal Revenue Code allows for non-simultaneous of investment property in the event escrows cannot be closed concurrently for the exchanged properties. The following are terms which are frequently used in connection with an exchange transaction.

ACCOMMODATOR

An Independent Third Party (a qualified intermediary) who enters into an agreement with the Taxpayer (Exchangor) to transfer the relinquished property from the Taxpayer to the Buyer. The Accommodator holds the proceeds of the relinquished property until they are invested in the replacement property. At the timer the Accommodator transfers title to the replacement property from the Seller to the Exchangor. The Accommodator cannot be the Exchanger’s agent.

BOOT

CONSTRUCTIVE RECEIPT

DEFERRED EXCHANGE (Non-Simultaneous)

DIRECT DEEDING

EXCHANGE AGREEMENT

EXCHANGER

LIKE-KIND PROPERTY

REALIZED GAIN

RECOGNIZED GAIN

RELATED PARTIES

RELINQUISHED PROPERTY

REPLACEMENT PROPERTY

REVERSE EXCHANGES

TIMING REQUIREMENTS

Seller of California Property

You must complete California withholding form 593-C to comply with the Franchise Tax Board withholding requirements. This must be done prior to the close of your sale escrow.